Lifetime Gift And Estate Tax Exemption 2024 Irs. Inflation, interest rates, estate tax and. The lifetime estate and gift tax exemption allows taxpayers to avoid tax on these transfers up to a certain amount.

The gift tax annual exclusion allows taxpayers to make certain gifts without eroding the taxpayer’s lifetime. The irs has announced that for 2024, the federal lifetime gift and estate tax exemption amount will increase to $13.61 million per person.

What Is The Gift Tax Annual Exclusion Amount For 2024?

But the government does put a lifetime limit on how much you can give before it wants its share.

But Because The Tcja Sunsets On December 31, 2025, The.

But exceeding the limit doesn’t necessarily result in owing tax, thanks to a high lifetime estate and gift tax exemption.

Lifetime Gift And Estate Tax Exemption 2024 Irs Images References :

Source: mashaqjulina.pages.dev

Source: mashaqjulina.pages.dev

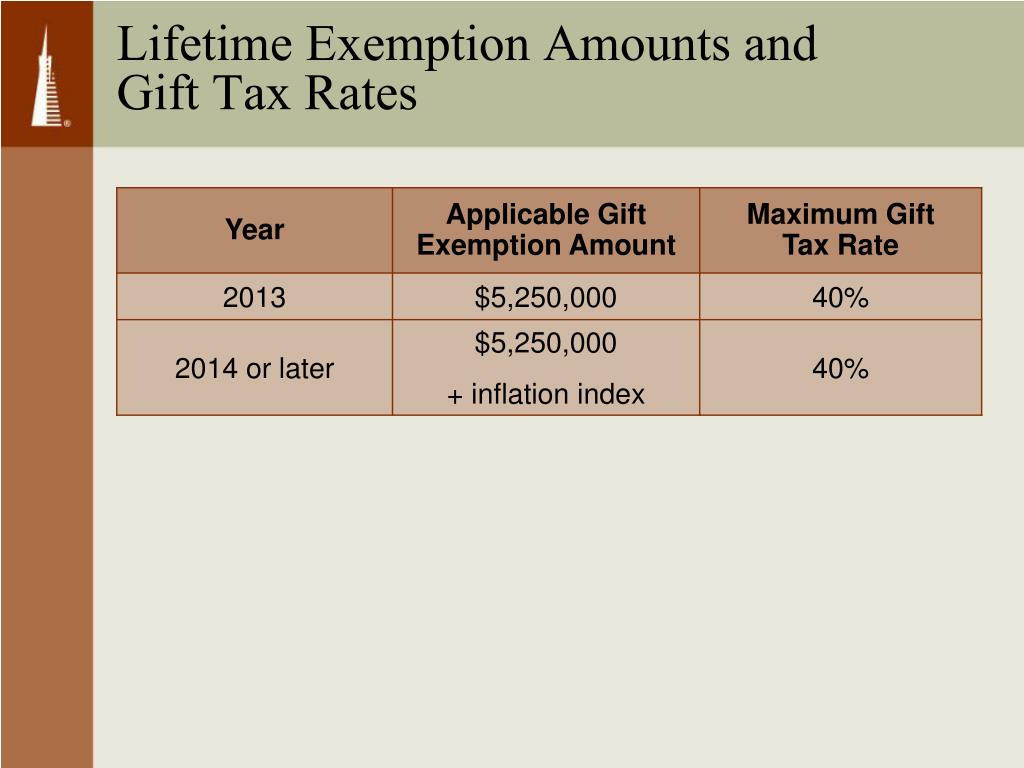

2024 Estate Tax Exemption Irs Andra Blanche, As announced by the irs, the key 2024 federal transfer tax exemption amounts per taxpayer are as follows: The tax cuts and jobs act delivered a sizable increase in the tax exemption limit for estates and lifetime gifts — up to $13.61 million per person in 2024.

Source: ernestawjolie.pages.dev

Source: ernestawjolie.pages.dev

2024 Gift Tax Lifetime Exemption Sybil Euphemia, The estate tax exemption in 2024 is $13.61 million for individuals and $27.22 million for couples. But exceeding the limit doesn't necessarily result in owing tax, thanks to a high lifetime estate and gift tax exemption.

Source: estatelawnewyork.com

Source: estatelawnewyork.com

IRS 2024 Lifetime Exemption Update Tax Implications and Financial, The 2024 annual exclusion amount will be $18,000 (up from $17,000 in 2023). In addition, her unused estate tax exemption of.

Source: billqjuliane.pages.dev

Source: billqjuliane.pages.dev

Lifetime Estate And Gift Tax Exemption 2024 Nancy Valerie, But exceeding the limit doesn't necessarily result in owing tax, thanks to a high lifetime estate and gift tax exemption. But the government does put a lifetime limit on how much you can give before it wants its share.

Source: billqjuliane.pages.dev

Source: billqjuliane.pages.dev

Lifetime Estate And Gift Tax Exemption 2024 Nancy Valerie, In 2023, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2024, estimated to be $19,000 in 2025). Estate & gift tax exemption:

Source: billqjuliane.pages.dev

Source: billqjuliane.pages.dev

Lifetime Estate And Gift Tax Exemption 2024 Nancy Valerie, In 2023, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2024, estimated to be $19,000 in 2025). For 2024, the lifetime gift tax exemption is $13.61 million, up from $12.92 million in 2023.

Source: imagetou.com

Source: imagetou.com

Annual Gifting For 2024 Image to u, It's great to give—and the government recognizes that. Furthermore, the irs has announced that the lifetime exemption from estate and gift tax will be raised to $13.61 million by the year 2024.

Source: www.carboncollective.co

Source: www.carboncollective.co

Lifetime Gift Tax Exemption 2022 & 2023 Definition & Calculation, If a gift exceeds the $18,000 limit for 2024, that does not automatically trigger the gift tax. Starting on january 1, 2024, the annual exclusion on gifts will be $18,000 per recipient.

Source: www.geigerlawoffice.com

Source: www.geigerlawoffice.com

The 2024 Estate & Gift Tax Exemption Amount Set to Rise Again Geiger, This means that any amount that you give over the annual limit is subtracted. In addition, her unused estate tax exemption of.

Source: fawnqjaquenetta.pages.dev

Source: fawnqjaquenetta.pages.dev

Federal Exemptions 2024 Nonna Annalise, The lifetime estate and gift tax exemption 2022 is $12.06 million. Any gift that surpasses the.

The 2024 Lifetime Federal Gift And Estate Tax Exemption Update Brings Significant Changes That Can Impact Your Estate Planning Strategy.

This means that you can give up to $13.61 million in gifts throughout your life without ever having to pay.

Any Gift That Surpasses The.

What is the gift tax annual exclusion amount for 2024?

Category: 2024